- How can you help protect yourself and your family financially should your income be affected in the event of illness or injury?

- How can you plan for events in the future, like your children going to college or your retirement?

Finding the answers to these questions can be daunting. Financial planning helps to give you peace of mind and helps you take care of the things that matter.

Who are Irish Life Financial Services and what do they do?

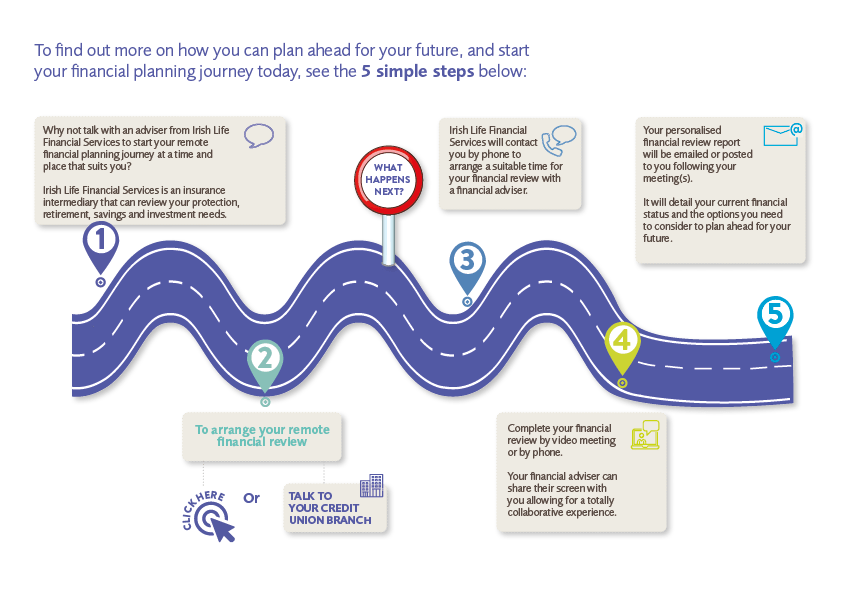

Irish Life Financial Services is an insurance intermediary that can review your protection, retirement, savings and investment needs, and they offer a full financial review with one of their Qualified Financial Advisers. This can be done online or over the phone at a time and place that suits you, taking just 45-60 minutes of your time. There is no obligation to purchase and all information you provide is private and confidential.

Irish Life Financial Services is tied to Irish Life Assurance for life and pensions, so any products recommended by Irish Life Financial Services will be from Irish Life Assurance, one of Ireland’s leading life and pension providers.

Irish Life Financial Services Limited is regulated by the Central Bank of Ireland. Irish Life Assurance plc is regulated by the Central Bank of Ireland.

1. Find out about you

2. Identify your needs

3. Agree your priorities

4. Consider your options

You will get a personalised report detailing your current financial status and options to consider, including the steps needed to help protect you and your family, and how to plan ahead for the future. Then it’s up to you to decide what to do next.

Irish Life Financial Services is tied to Irish Life Assurance for life and pensions.

Irish Life Financial Services Limited is regulated by the Central Bank of Ireland.

Irish Life Assurance plc is regulated by the Central Bank of Ireland.